Introducing a controversial sweetener into a market whose history has long been rooted in sugar will always yield questions about its intent, impact, and what it will take for the community to accept this foreign invasion. Yet, Bacolod’s current stance on high fructose corn syrup (HFCS) sums up the sugar industry’s feelings for the cost-effective alternative.

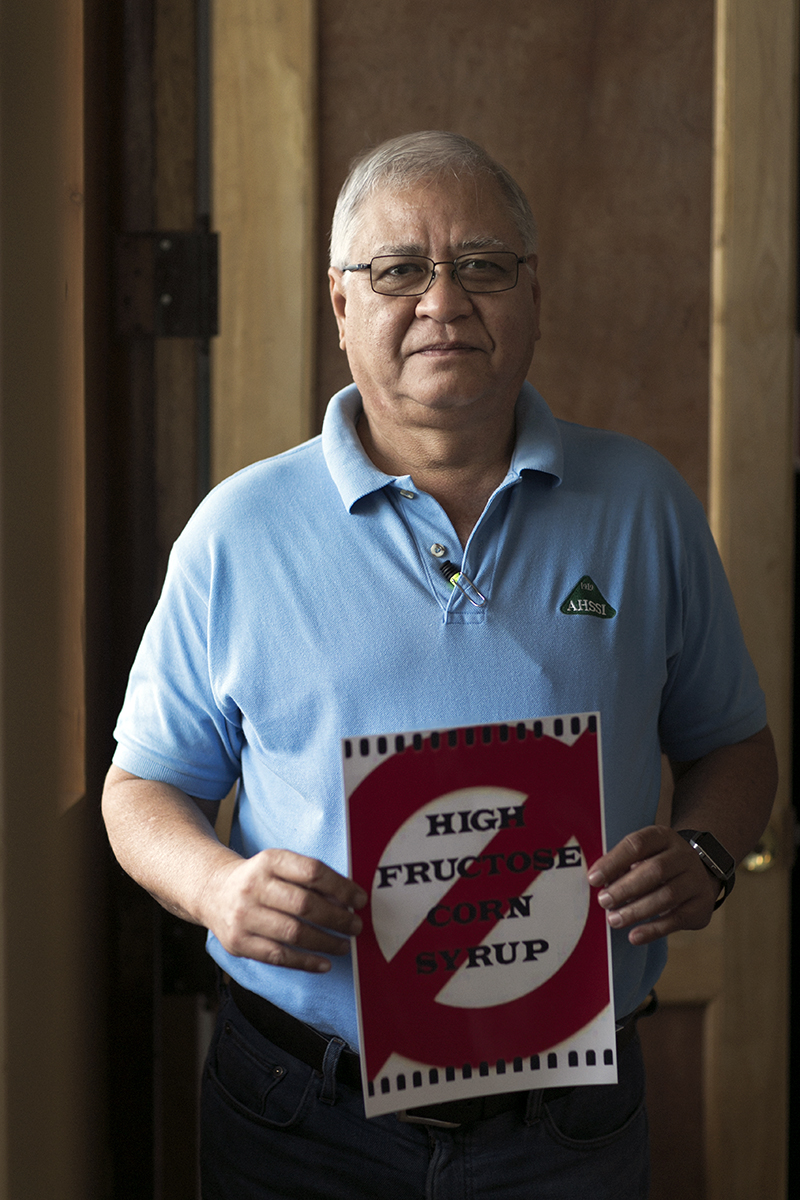

A quick look at the Killer Cola posters plastered all over the city is proof enough that the wheels have fallen of in the City of Smiles. There’s also the “Pinoy ba sugar mo?” campaign, which was originally created in 2012 to promote Philippine sugar but now serves as the main argument expressing the sugar industry’s apparent angst. It aims to fire up the people to rally against HFCS importers.

In the 11 years since HFCS was first imported into the country, the protracted decomposition finally reached its peak, dissolving exponentially in 2016 when the HFCS influx was at an all-time high.

No sugarcoating when it comes to high fructose corn syrup

Statistics from industry sources show that HFCS first reached local shores in 2006, but it wasn’t until last year when sugar producers felt the heat. What started with a seemingly harmless 18,363 kilos of HFCS imported in 2006—mostly from the United States—increased to the staggering 373,137,994.18 kilos of HFCS imports from China and South Korea last year valued at nearly P7.5 billion. It’s not surprising that the huge volumes have angered the sugar industry considering

that “there are about five million people who depend on sugar,” says Confederation of Sugar Producers Association Inc (ConFed) president Francis De La Rama.

What started with a seemingly harmless 18,363 kilos of high fructose corn syrup imported in 2006—mostly from the United States—increased to the staggering 373,137,994.18 kilos of HFCS imports from China and South Korea last year valued at nearly P7.5 billion.

It must be noted that while Pepsi-Cola Products Philippines and other industrial users also utilize HFCS, Coca-Cola was almost exclusively singled out because they are the biggest importer of the sweetener. “The other beverage corporations usually use 50:50 ratio, while they admitted to using up to 90 percent HFCS and 10 percent locally grown sugar,” explains Atty. Dino Yulo, spokesperson of the Sugar Alliance of the Philippines, a group made up of four major sugar federations including ConFed, the United Sugar Producers Federation of the Philippines, the National Federation of Sugar Planters, and the Panay Federation of Sugarcane Farmers, Inc. (PanayFed).

“Now, we’re worried because those companies used to be our biggest buyers,” says De La Rama. “And the threat of HFCS is here.” From P1,700 to P1,800 per 50-kg bag when milling started in September 2016, sugar prices have since plummeted to P1,300 per bag.

With production for this crop year estimated at 2.3 to 2.4 million metric tons and US export quota (dubbed “A” sugar) only at eight percent or 137,000 metric tons and assuming domestic consumption (branded “B” sugar) dramatically falls below the usual 1.8 to 2 million metric tons, the result could be a supply overhang ranging from 400,000 to 600,000 metric tons. This could further affect prices in the next crop year—if this oversupply isn’t absorbed by the market. “It’s not just a question of price,” states Rafael Coscolluela, former Negros Occidental governor and Sugar Regulatory Administration (SRA) administrator. “Traders may not want to buy when milling starts [in August or September] until their stocks are gone.”

When the issue first came to light, says Yulo, the locals’ attitudes towards HFCS was just as revealing. They ditched subtlety and opted to express their collective disapproval with high-octane messages and push the discourse into a territory that tap into Negros’ tempestuous history, complex sugar economics, and national apathy.

“High fructose corn syrup is the major competition. If you need two teaspoons of sugar for your coffee, you’d only need a teaspoon of HFCS. It’s 50 percent less in terms of volume but it could mean savings of 60 to 70 percent in your cost,” says Rafael Coscolluela.

Three high-profile developments ensued. In January 2017, Negros Occidental Fifth District Board Member Alain Gatuslao planned for the probe of HFCS’ entry. The following month, the Sugar Regulatory Administration issued Sugar Order No. 3, which regulates the issuance of clearances for releasing HFCS and chemically pure fructose imports. In March, the industry called for a boycott of HFCS products in restaurants and festivals.

Then again, expectations have changed since the unprecedented standoff began.

“We have plateaued actually,” says Yulo. However, he confirmed that the boycott still stands. “But they already withdrew the case [seeking to nullify SO No. 3] before the Quezon City Regional Trial Court, so we hope the withdrawal will be a confidence-building measure to come to an agreement that would help both the beverage and sugar industry.”

Soft power

Negros is still the top producer of sugar in the Philippines, accounting for 60 percent of the national output. It’s home to 11 sugar mills—which include the Lopez Sugar Corporation, Victorias Milling Company, Hawaiian-Philippine Company, the First Farmers Holding Corporation as well as a cluster of family-owned businesses that build the backbone of the economy. The now-defunct publication Sugarland even documented the flourishing sugar lifestyle and put into perspective the industry’s impact.

Cutouts of the vintage magazine now reside in Café Uma, a progressive heritage restaurant established in 2001 that also serves as a focal point for the sugar industry’s survival. Its owner, Joey Gaston, also of Hacienda Crafts and former Association of Negros Producers president, sees the whole conflict from a broader perspective.

In the US, the high fructose corn syrup industry waged an expensive and intricate campaign to sell the sweetener, which comes in two compositions, HFCS-42 and HFCS-55 or 42 or 55 percent fructose and the remaining being glucose, as just like sugar.

“This is an effect of Spanish and American colonization; it’s been [ingrained] in our culture to just follow and not take on and think of the bigger picture. HFCS is just one of the many issues.” What he is alluding to are the corn lobby against sugar and HFCS’ detrimental health effects.

In the US, the HFCS industry waged an expensive and intricate campaign to sell HFCS, which comes in two compositions, HFCS-42 and HFCS-55 or 42 or 55 percent fructose and the remaining being glucose, as just like sugar. What is happening here is a reflection of the bitter battle between two sweet industries in countries like the US and Mexico where “unfair trade practices” and the threat of higher tariffs have pushed the HFCS industry to look at alternative markets.

External issues

In a span of 10 years, Negros is again greeted with a seismic undertaking calling to mind the Batang Negros and “sunset industry” memories. Ten years is a long time but the simmering buildup to HFCS’ emergence today reveals a critical flaw of unregulated free trade. “For the last seven years, no one batted an eye,” says Coscolluela. “Then the industry started noticing a drop in the withdrawals of refined sugar from the refineries. In other words, while traders were buying their sugar quedans (a tradable certificate that tells how much sugar a mill has) and having them refined, the sugar wasn’t going to the end user. It was staying in the bodegas.”

In the wake of these analyses, Coscolluela believes that while HFCS displaced the sugar market, reduced demand could also have been the outcome of a chilling theory going around in the southern Philippines’ pervious borders: smuggled sugar trickling in, quickly re-bagged into local sacks or plastic bags and then absorbed in the retail market.

And arriving on the heels of HFCS’ crossover prospect and speculations of smuggling, sugar producers are grappling with a more alarming, murkier threat: an excise tax on sugar-sweetened beverages.

“This is an effect of Spanish and American colonization; it’s been [ingrained] in our culture to just follow and not take on and think of the bigger picture. High fructose corn syrup is just one of the many issues,” says Joey Gaston.

In the tax reform package, sweetened juice drinks, carbonated beverages, and sweetened tea and coffee will be imposed with a P10 per liter excise tax—a virtual industry backlash waiting to happen. “We’re going to be hit by that,” says Yulo. “We’re even going to be hit by the excise tax on diesel fuel because the sugar industry relies heavily on the use of diesel [to transport sugar canes from the farm to the mill].

“And then next year we’re going to have an increase in land tax. All of these will factor into the sugar industry. That’s why we’re asking, is this the policy of the government? Do you still want us to continue planting sugar or do you want us to look for an alternative crop?” says Yulo.

View from the other side

In September 2016, the Beverage Industry Association of the Philippines released a position paper opposing House Bill No. 292 or the Sweetened Beverage Tax, which the association believes is both discriminatory and regressive.

“What they’re saying is when you impose excise taxes on sugar sweetened beverages, the price will increase. When the price increases, demand drops. When demand drops, naturally demand for sweeteners will drop,” explains Coscolluela, forecasting a probable shift in the market demand for the non-sweetened sector. For example, the price of 3-in-1 coffee—a staple in rural areas—will increase from P5 to P7 or P8 if the tax rate is approved. A beverage firm’s response? “Huwag na tayong mag-3-in-1. No more sugar. 2-in-1 or stick to classic coffee,” Coscolluela says.

The big question, of course, is where Negros goes from here. Unlike its foreign counterparts, say, Thailand where subsidies are provided, HFCS importation isn’t allowed, and 100 percent cane sugar is used says De La Rama, Negros’ history of weathering storms has always been driven by reinvention. Negros has been rocked by decades of internal and external turmoil. Ravages. Even insurgency. It has happened before but not on this scale.

“The bigger picture is Philippine sugar has to become competitive within the sphere of the world market. That’s what we aim for. It’s true that Philippine sugar is expensive, that’s why we need to become more efficient,” says Atty. Dino Yulo.

A crisis is depressing but it sure shakes up people into moving forward. What Negros needs now is a fresh infusion of ideas and a refocusing of their efforts to effect change that remains faithful to Negros’ traditions. “I remember when they were telling us to diversify because the ’80s also had a sugar crisis. People diversified in a big way—from prawns to ramie. There were players that put up facilities here to process it,” Gaston says of the awakening. But it’s not as easy as when you come up with barriers like dwindling labor, poor technology, lack of mechanization, the effects of land reform, and insufficient R&D.

That isn’t to say that a definitive solution will come out of addressing these problems, rather that alternatives will arise with progressive vision.

“The enemy is high fructose corn syrup and not Coca-Cola or any other industrial user,” says Rafael Coscolluela. “We can convince the consumer not to accept any product with high fructose corn syrup or let’s begin diversifying our product line because we’ve always said that the sugar industry should be the sugar cane industry.

“Why not focus on our capabilities, skills, and resources?” says Gaston. “It’s a matter of finding the market fit and searching for more efficient ways of doing what the farmers are doing. There’s already an existing industry doing it for 150 years. The distribution channels are set, the infrastructure is being improved.”

Moreover, the Sugar Industry Development Act of 2015 is providing the sugar industry, after being excluded in the general appropriations budget, through SRA P2 billion every year for the next 10 years to modernize the industry and increase productivity.

The future with high fructose corn syrup

The reality is, Negros isn’t isolated. It’s dealing with the world. Producers may be banding together to stop the bleeding but they shouldn’t lose sight of their responsibility to evolve with the times. Charting a new course for sugar is the bolder, riskier alternative and the trap that the industry needs to avoid is to retain the “business as usual” mindset.

“The enemy is HFCS and not Coca-Cola or any other industrial user,” says Coscolluela. “We can convince the consumer not to accept any product with HFCS or let’s begin diversifying our product line because we’ve always said that the sugar industry should be the sugar cane industry. The sugar cane can produce so many products. There’s raw refined sugar, molasses from which you can produce ethanol.” There’s also bagas, a fibrous byproduct used as fuel to generate heat and power. De La Rama also mentioned SanMig Cola, San Miguel’s valiant attempt to support the industry by using 100 percent local sugar.

“You diversify horizontally and vertically, in the field and in the factory, and then you find different uses so that maybe, half your output now goes to the retail market for refined sugar and then the rest will go to specialty markets. That’s the future the industry should be taking,” says Coscolluela.

“You diversify horizontally and vertically, in the field and in the factory, and then you find different uses so that maybe, half your output now goes to the retail market for refined sugar and then the rest will go to specialty markets. That’s the future the industry should be taking,” says Rafael Coscolluela.

That said, Coscolluela also believes that rescuing the industry’s future isn’t solely in the hands of those who cut canes. Savvy strategies are needed to save it, like investing in R&D or an environment policy that makes Philippine agriculture competitive.

“The bigger picture is Philippine sugar has to become competitive within the sphere of the world market. That’s what we aim for. It’s true that Philippine sugar is expensive, that’s why we need to become more efficient,” says Yulo.

But this critical point also has its moments of clarity—despite, or maybe because of, high fructose corn syrup’s gall to disrupt the market, the sugar industry has since closed ranks, strengthening its alliance to denounce a common enemy. “One of the most disunited industries is the sugar industry,” admits Yulo. “Take a look at how many federations and associations we have. Maybe we can use this as a launchpad to really come together.”

It’s a struggle rife with unforgiving pressure but what will follow in its mighty wake? If Negros fails to explore all avenues, it at least inspires belief that this riveting journey of self-discovery will swell into a storm of a sweet comeback.

Originally published in F&B Report Vol. 14 No. 4